regional income tax agency estimated payments

The Income Tax office hours are 800 am to 430 pm Monday through Friday. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and.

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

5 Regional Income Tax Agency Estimated.

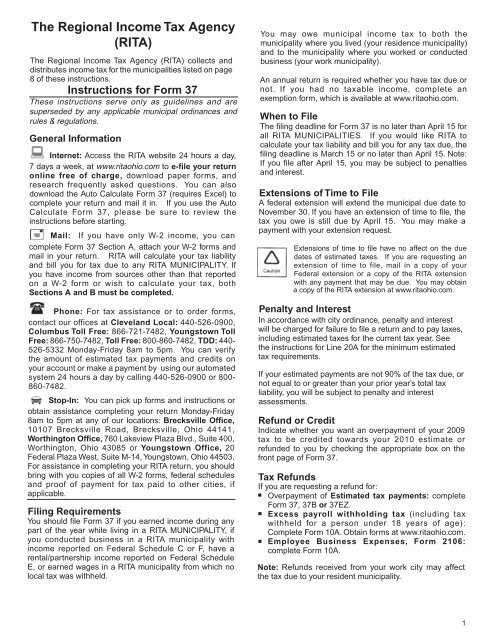

. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online. Taxpayer Quarterly Estimated Payments. Taxpayer Annual Local Tax Return.

If youd like a CCA team member to complete your municipal income tax return please fill out the CCA Division of Taxation Taxpayer Assistance Form found on the Tax Forms page of this. Taxpayers can use the Drop-off preparation service see below The Cincinnati Income Tax. Form 32-EXT is available at.

CLEVELAND OH 44101-2004 BROADVIEW HEIGHTS. REGIONAL INCOME TAX AGENCY REGIONAL INCOME. Estimated Taxes - Who Needs to Pay Them.

REGIONAL INCOME TAX AGENCY REGIONAL INCOME. How Much Does Regional Income Tax Agency Pay. If you file on an extension your first.

Nonresident aliens use Form 1040-ES NR to figure estimated tax. 5 Regional Income Tax Agency Estimated Income Tax andor. ADAMS TAX COLLECTION DISTRICT.

Tax Collection Agency Website Tax Officer Address Phone Number. Quarterly estimated tax payments are required to be made by the 15th day of the 4th 6th 9th and 12th months of the tax year. Back To Income Tax Home.

Typically no federal income tax is withheld from any of them. Do NOT check this box if you are only making an Estimated Tax payment. Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482.

Posted Wed May 6 2015 at 1153 am ET. Use View and cancel scheduled payments in your Online Services account to cancel the payment. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time.

Estimated Payment not less than 14 of Line 3 00 Note. Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments. That means you may be required to make estimated tax payments.

5 Regional Income Tax Agency Estimated Income Tax andor. Municipal income tax return by completing Form 32-EXT Estimated Income Tax andor Extension of Time to File which is due on or before April 17 2018. Corporations are required to pay estimated income tax if the corporations income tax less any credits for the taxable year can reasonably be expected to be 500 or more.

If you dont have an Online Services account see Create account. Are you required to pay estimated taxes. 5 REGIONAL INCOME TAX AGENCY Net Profit.

Extension of Time to File. Estimated Income Tax andor Extension of Time to File.

Ohio Regional Income Tax Return Rita Support

Income Tax City Of Gahanna Ohio

The Regional Income Tax Agency Rita

![]()

Home Regional Income Tax Agency

Income Tax City Of Gahanna Ohio

Home Regional Income Tax Agency

The Regional Income Tax Agency Rita

Rita Ohio The Regional Income Tax Agency 2020 Tronzi

Paid Income Tax For A City You Didn T Work In 2021 Here S How To Get Your Refund Cleveland Com

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Rita 101 Regional Income Tax In Ohio Dca Cpa S

![]()

Home Regional Income Tax Agency